What Does “Subject-To” Even Mean?

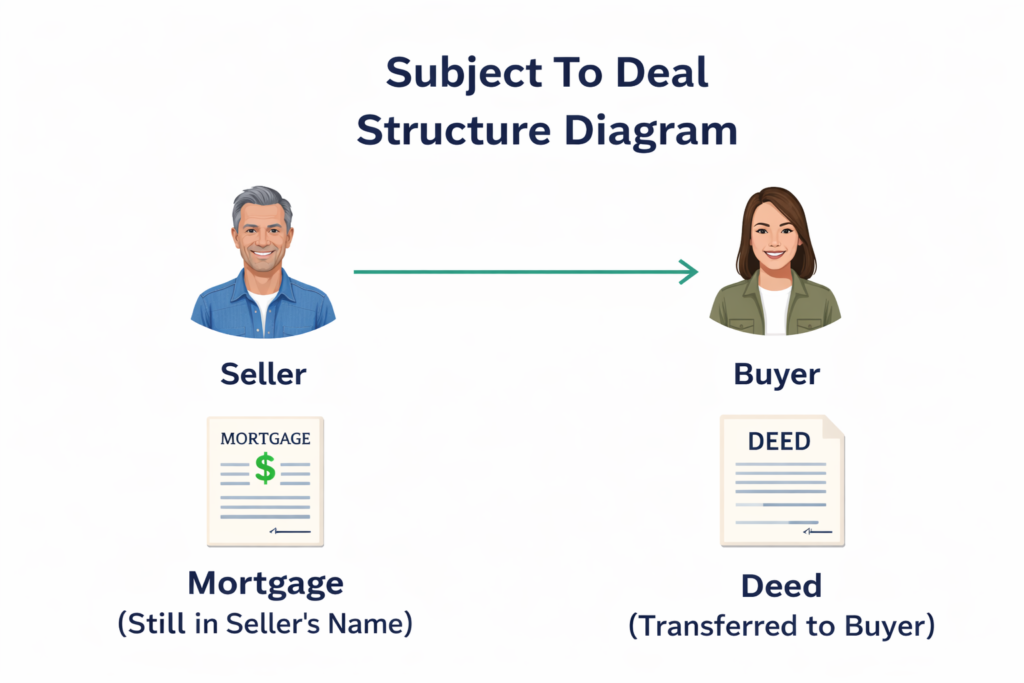

In real estate, a “subject-to” deal means you’re buying a property subject to the existing mortgage. In plain English — the deed transfers to you, but the seller’s mortgage stays in their name. You take over the payments, but you don’t formally assume the loan.

Read that again because it trips people up. The loan doesn’t change. The seller’s name is still on the mortgage. But you own the property. You make the payments. You collect the rent. You hold the deed.

Sounds wild, right? But it’s completely legal and has been used by savvy investors for decades.

How Does a Subject-To Deal Work?

Let’s walk through it step by step:

- You find a motivated seller. This is usually someone who needs to sell quickly — maybe they’re behind on payments, relocating for work, going through a divorce, or just can’t afford the property anymore.

- You negotiate the deal. You agree to take over their mortgage payments. The seller gets out from under the burden. You might pay a small amount at closing (to cover their moving costs, back payments, etc.), or sometimes nothing at all.

- The deed is transferred to you. Through a title company or attorney, the property deed is recorded in your name.

- The mortgage stays in the seller’s name. You don’t go to the bank. You don’t apply for anything. The existing loan just keeps getting paid — by you now instead of them.

- You use the property however you want. Rent it out, do the BRRRR strategy, live in it, or eventually refinance and pay off that original mortgage.

Why Would a Seller Agree to a Subject-To Deal?

This is the number one question people ask. Why would anyone let you take their property and leave their mortgage in their name?

Here’s the reality — sellers who agree to subject-to deals are usually in tough situations:

- They’re behind on payments and facing foreclosure. A subject-to deal saves their credit because the payments start getting made again.

- They owe more than the property is worth (underwater). They can’t sell traditionally without bringing money to the closing table.

- They need to relocate fast and can’t wait months for a traditional sale.

- They’ve inherited a property they don’t want and just need someone to take over the problem.

For these sellers, a subject-to deal is often their best option. It’s not exploitation — it’s solving a problem that nobody else will solve for them.

What Makes Subject-To Different From Assuming a Mortgage?

When you assume a mortgage, you formally take over the loan. The bank approves you, your name goes on the mortgage, and the original borrower is released. It’s official and above board with the lender’s blessing.

With subject-to, the bank doesn’t know about the transfer. The loan stays exactly as it is. The only thing that changes is who holds the deed and who’s making the payments.

This is the part that makes people nervous — and honestly, it should. Because there’s a big risk here called the due-on-sale clause.

The Due-on-Sale Clause — The Biggest Risk

Almost every mortgage has a due-on-sale clause. This means if the property is sold or transferred, the lender has the right to call the entire loan due immediately.

In theory, when the bank finds out the deed has changed hands, they could demand the full payoff. If you can’t pay it, they foreclose.

In practice? Banks rarely enforce this clause as long as the payments are being made on time. They care about getting their money, not about who’s writing the check. But “rarely” is not “never,” and you need to understand this risk going in.

How Do Investors Profit From Subject-To Deals?

The math is where this gets exciting. Here’s a real-world example:

- Seller owes $180,000 on their mortgage at 3.5% interest

- Property is worth $230,000

- Monthly mortgage payment is $1,100

- Market rent is $1,800/month

You take over the property subject-to. You now have a $1,800/month income stream with a $1,100 payment. That’s $700/month cash flow before expenses. Plus, you locked in a 3.5% interest rate that’s no longer available on the market.

And you did this with little to no money down. No bank qualification. No 20% down payment. No mortgage insurance.

When you’re ready to move on, you can do a cash-out refinance to pay off the original mortgage and lock in your own financing.

What You Need to Have in Place Before Doing a Subject-To Deal

- A real estate attorney. Non-negotiable. You need someone who knows subject-to transactions and can draft the right paperwork.

- A title company. To handle the deed transfer and make sure the title is clean.

- Insurance in your name. You need to insure the property since you own it now.

- A plan for the due-on-sale risk. Have enough reserves or a refinancing plan in case the bank calls the loan.

- Clear communication with the seller. They need to understand that their name stays on the mortgage and what that means for them.

Frequently Asked Questions

Is a subject-to deal legal?

Yes. Buying property subject to an existing mortgage is legal in all 50 states. It’s a deed transfer, not a loan assumption. However, it may trigger the due-on-sale clause — which is a contractual risk, not a legal issue.

How do I find subject-to deals?

Look for motivated sellers — people behind on payments, going through divorce, relocating, or dealing with inherited properties. Direct mail, driving for dollars, and working with wholesalers are common ways to find these sellers.

What happens if the seller declares bankruptcy after the deal?

This is a real risk. If the seller files bankruptcy, the mortgage could get caught up in the proceedings. An experienced attorney can help you structure the deal to minimize this risk.

Can I use subject-to with the BRRRR method?

Absolutely. You acquire subject-to, rehab the property, rent it out, and then refinance to pay off the original mortgage. It’s a powerful combination. Learn more about the BRRRR method here.

Bottom Line

Subject-to deals are one of the most powerful creative financing strategies in real estate. They let you acquire properties with minimal cash, inherit favorable interest rates, and build your portfolio without traditional bank lending. But they come with real risks — especially the due-on-sale clause — that you need to understand and plan for.

If you’re serious about real estate investing and you want to learn how to buy properties that other people walk away from, subject-to is a strategy worth mastering.